⚡ BREAKING INVESTIGATION ⚡

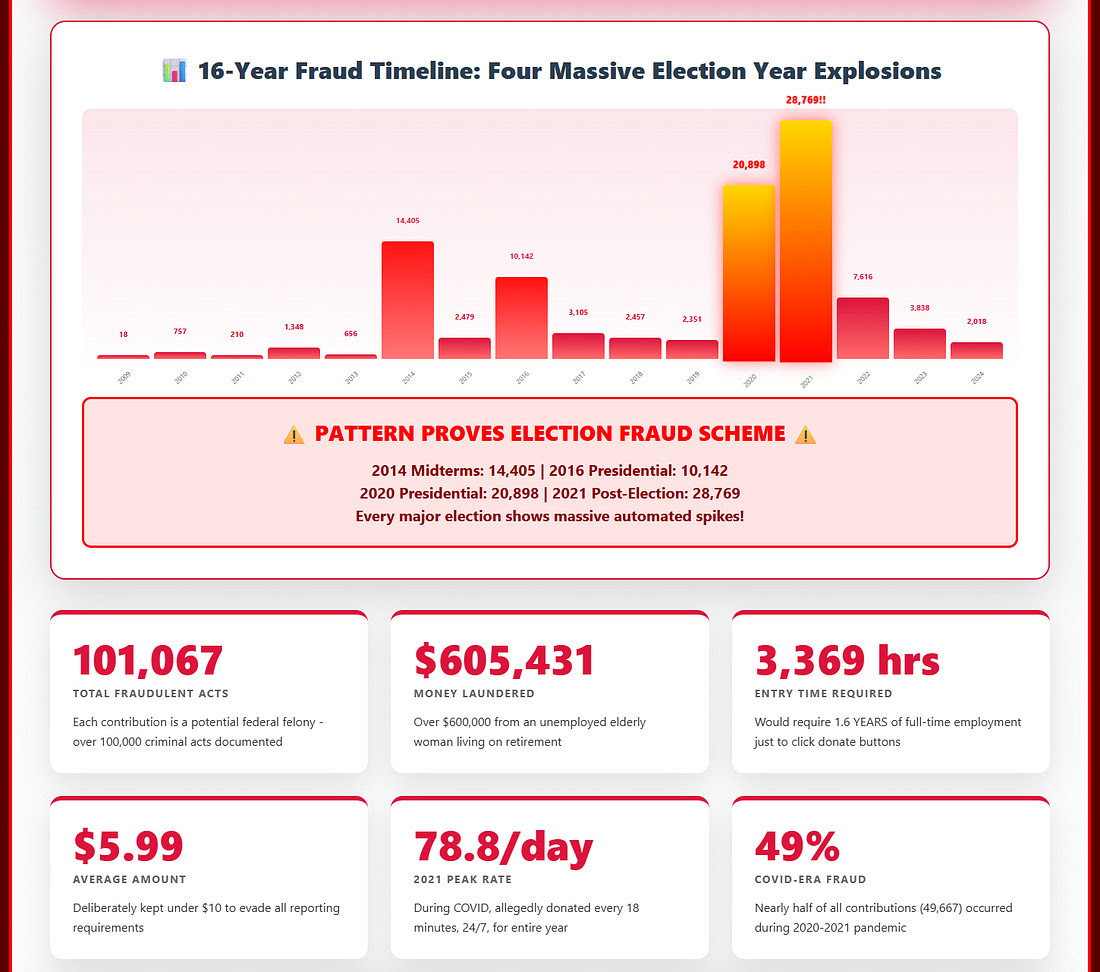

Largest Straw Donor Campaign Finance Fraud Ever Documented 101,067 Political Donations From ONE Elderly Woman

NATIONAL SECURITY EMERGENCY

101,067 fraudulent contributions. $605,431 laundered. 16 years of continuous crime.

During COVID-19, while isolated and vulnerable, this elderly woman allegedly made

78.8 political donations EVERY SINGLE DAY

One donation every 18 minutes, 24/7, for an entire year.

This is MATHEMATICAL PROOF of the largest campaign finance

fraud operation ever documented in American history.

If they did this to ONE elderly woman, how many THOUSANDS of others?

This demands IMMEDIATE federal investigation by DOJ, FBI, FEC.

IS THIS SCHEME A TAXABLE EVENT FOR SONIA?

As a 77-80-year-old retiree listed as “NOT EMPLOYED,” Sonia’s situation suggests she’s likely on a fixed income (e.g., Social Security, pensions). If contributions were made in her name without her knowledge via a fraudulently created or compromised asset account, here’s how tax implications could arise:

Potential Taxable Event from Fraudulent Account Funding:

If bad actors created an asset account (e.g., bank account, prepaid card) in Sonia’s name and funded it with $605,431.37 to make these contributions, the IRS could mistakenly view these funds as income to Sonia if they appeared in an account under her Social Security Number (SSN) or Taxpayer ID.

Bank Reporting: Banks report interest income (Form 1099-INT) or miscellaneous income (Form 1099-MISC/1099-NEC) to the IRS for accounts under a person’s SSN. If large sums were deposited into an account in Sonia’s name, the IRS might assume she received:

Interest Income: Even minimal interest on $605,431 could trigger a 1099-INT, creating a tax liability (e.g., 1% interest = ~$6,054 taxable).

Miscellaneous Income: If funds were deposited as “gifts” or transfers, the IRS could misclassify them as income, especially if not reported as nontaxable by the account holder.

Example: In 2021 alone (28,769 contributions, $128,659), if funds passed through a bank account in her name, deposits could be flagged as income, potentially increasing her tax liability by tens of thousands, depending on her tax bracket and filing status.

Unreported Income Risk:

If Sonia was unaware of the account (as implied by the O’Keefe investigation), she wouldn’t report these deposits as nontaxable or dispute them, leading to IRS notices for unreported income.

The IRS could assess taxes, penalties, and interest, especially for high-volume years like 2020 ($108,352) or 2021 ($128,659). For a retiree on fixed income, this could be financially devastating, compounding the elder abuse aspect.

Identity Theft Fallout:

Fraudulent accounts tied to her SSN could trigger IRS audits or flags under the Bank Secrecy Act (BSA), as deposits over $10,000 (or suspicious patterns) prompt Currency Transaction Reports (CTRs) or Suspicious Activity Reports (SARs).

Sonia could face tax disputes, credit damage, or legal costs to resolve these issues, even though she’s a victim, as the IRS initially assumes account activity is legitimate.

Are These Taxable Events for the Bad Actors Funding the Accounts?

The bad actors funding the asset account(s) to facilitate the smurfing scheme face different tax considerations, depending on how they structured the operation:

No Direct Taxable Event for Contributions:

Like Sonia, the act of funding political contributions doesn’t create taxable income for the bad actors, as donations aren’t income-generating.

However, the source of the funds and how they’re transferred could trigger tax scrutiny.

Funding Source and Income Recognition:

If bad actors used personal or business funds to deposit $605,431 into Sonia’s account(s), those funds are likely already taxed (e.g., as income, capital gains) or derived from illicit sources (e.g., money laundering, unreported income).

Gift Tax: If funds were transferred to Sonia’s account as a “gift” to avoid detection, the IRS could view them as taxable gifts if exceeding the annual exclusion ($18,000 per recipient in 2025). Over 16 years, $605,431 far exceeds this, potentially triggering gift tax liability for the funder (up to 40% on amounts above the lifetime exemption, ~$13.6M in 2025).

Illicit Funds: If funds came from unreported sources (e.g., cash, cryptocurrency, or offshore accounts), the bad actors could face tax evasion charges under IRC § 7201, especially if the IRS links the funds to unreported income.

Money Laundering and Structuring:

Depositing funds in small amounts to avoid CTRs (>$10,000) or detection is called “structuring,” a crime under 31 U.S.C. § 5324. The micro-transaction pattern (78% ≤$5) aligns with this, but if aggregated deposits hit thresholds, SARs could flag the accounts.

If caught, bad actors could owe taxes on illicit funds, plus penalties (up to 50% for willful evasion) and face criminal prosecution.

Business or Shell Entity Involvement:

If funds were funneled through a business or shell company, the IRS could audit for improper deductions (e.g., claiming donations as business expenses) or unreported income. This could lead to back taxes, penalties, and interest.

Shell entities hiding the true donor could trigger IRS scrutiny under anti-money-laundering rules or FATCA (Foreign Account Tax Compliance Act) if offshore accounts were used.

Broader Implications

For Sonia: The tax burden could be catastrophic if the IRS attributes deposits to her without her knowledge. For example, $128,659 in 2021 alone could push her into a higher tax bracket (e.g., 22% federal + state taxes), owing ~$30,000+ in taxes she can’t pay as an unemployed retiree. Resolving this would require proving identity theft, a lengthy and costly process.

For Bad Actors: Tax evasion risks are high if funds are unreported or structured to avoid detection. The IRS’s Criminal Investigation Division could pursue them alongside FEC violations (52 U.S.C. § 30122) and RICO charges, given the 16-year pattern and $605,431 scale.

Systemic Impact: If O’Keefe’s investigation points to multiple victims, thousands of fraudulent accounts could generate millions in misreported “income” to victims, overwhelming IRS systems and victim resources while shielding bad actors’ tax liabilities.

Data Context and Specifics

The FEC data shows:

2021 Peak: 28,769 contributions ($128,659) – likely required sustained funding into an account, potentially triggering 1099s or CTRs if not carefully structured.

Micro-Transactions: 78% ≤$5, suggesting deliberate structuring to avoid bank/IRS flags, but aggregate deposits (e.g., $108,352 in 2020) could still trigger SARs.

ActBlue Dominance: 82%+ to Committee C00401224 (ActBlue), processed via automated systems, implying a linked account (bank/card) in Sonia’s name.

Conclusion

Yes, the smurfing scheme would likely create taxable events:

For Sonia: Deposits into a fraudulent account in her name could be misclassified as income, leading to tax liabilities, audits, or penalties she’s ill-equipped to handle, exacerbating the elder abuse. Proving identity theft to the IRS would be her only recourse, a daunting task for a retiree.

For Bad Actors: Funding the account risks gift tax, tax evasion, or structuring charges, especially if illicit or unreported funds were used. The scale ($605,431) and duration (16 years) make IRS and DOJ scrutiny likely if traced.

This adds another layer of criminality, tax fraud; on top of campaign finance violations, identity theft, and elder abuse.